WordPress Accounting For

Non-Accountants

The intuitive & interactive system of WordPress Accounting makes it possible for beginners to understand & work smoothly

with trial balance, ledger reports, balance sheets, income statements & more even without

understanding debits & credits.

Advantages of Using A WordPress

Accounting Module

Journals for Double-Entry System

Easy Payments for You &

Your Customers

Statements

to Do Calculations

Graphic Overviews

for Decision-making

Keep Your Cash & Bank

Account Synchronized

Key Journal Entries into The System in a Flash.

Overview of Accounting

With the graphical dashboard, quickly view all important information like income & expenses,

accounts receivables, accounts payables, cash, and bank balance.

Payment Gateway

Take payments directly from your invoices with PayPal & Stripe Gateway

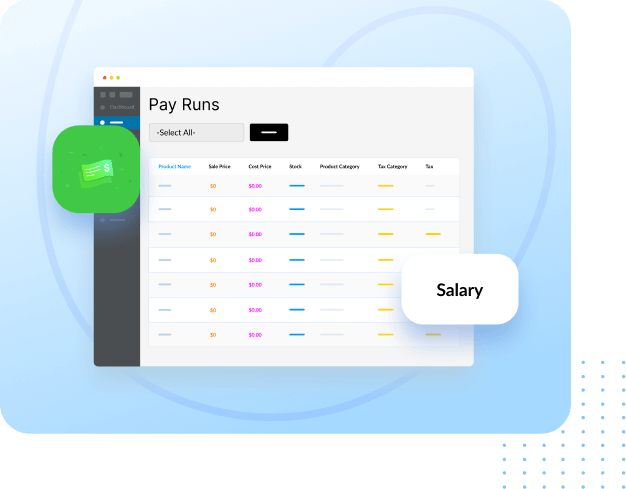

Payroll

Payroll enables you to manage your employees’ salaries from the dashboard

Workflow

Set Events like creating or deleting customers, and adding automation!

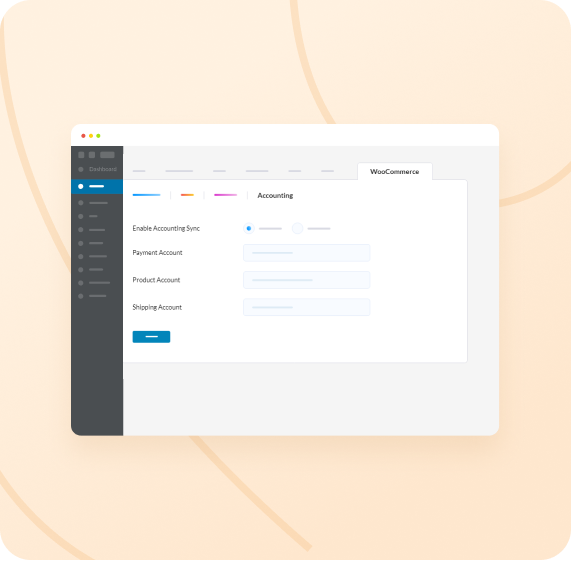

WooCommerce

Integration

Sync All Your Client Data from WooCommerce

Inventory

This inventory management system works with invoicing, stock, and more

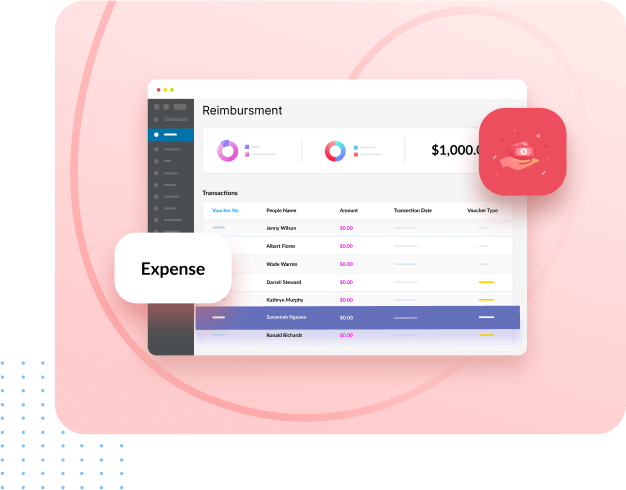

Reimbursements

Employees can request for reimburse payments from a single place

Custom Field Builder

Add extra fields for employees or companies

Manage All Business

Transactions with WP ERP

From accepting payments to managing inventory, get it all done digitally

with our feature- rich accounting extensions

Merge Your WooCommerce Store with WP ERP

Supercharge your WooCommerce store with powerful Accounting integrations and manage customers easily. Sync all your order details, see your sales overview, choose the payment account, or check who has purchased Less or More than a specific amount all with this extension.

Get An Interactive Inventory Manager

Stock management for your products within your accounting software is now available with this extension. Stay ahead of your finished stocks & goods with the must-have WordPress Inventory Management plugin.

Use PayPal & Stripe

As Payment GatewayAvail payment options for your site with the most popular payment gateways – PayPal and Stripe. Choose which account you want to take the payments in. You have the ability to choose your desired payment account.

Take Control of Your Employee’s Payment

and Compensation Arrangement

Handle every aspect of salary payments, distribution, or even expense tracking of a

company with the WordPress Accounting extensions

Manage Employee

Salaries Digitally with

Payroll

The payroll extension enables you to manage your

employees’ salary from the WordPress

dashboard.

Track Office Expenses with

Reimbursement

Manage employee expenses & complete

payments in an easy and effective way.

Keep accounts of the expenses made by employees

easily.

Generate Digital Invoices for Any Kind of

Business Transaction

You can easily handle and create invoices for expenses or sales transactions like purchasing goods in cash, on

credit, or in installments. Get the actual scenario of total outstanding & received amounts, over-dues, partial

& more with diagrams.

Create An Accurate

Transaction Value

Unlike creating invoices directly,

creating an estimate is an advanced feature that lets you create a draft invoice for future quotations.

Create Invoice &

Receive Payments

Manage employee salaries more easily & automate payments with WordPress Payroll System Plugin

The payroll extension enables you to manage your employees’ salaries from the WordPress dashboard

Option to Delete an Invoice

Like Actual Accounting

Keep track of all the assets of your workplace without any hassle

Manage your office inventory with ease, assign assets to employees, and collect them back on time

Say No to Manual Calculations!

Manage Your Business Accounting

Digitally with WP ERP

Automatically Calculate Sales Tax

with WP ERP

No more hassle of calculating tax for every transaction! With the WordPress Accounting module, your tax

rates will be automatically calculated.

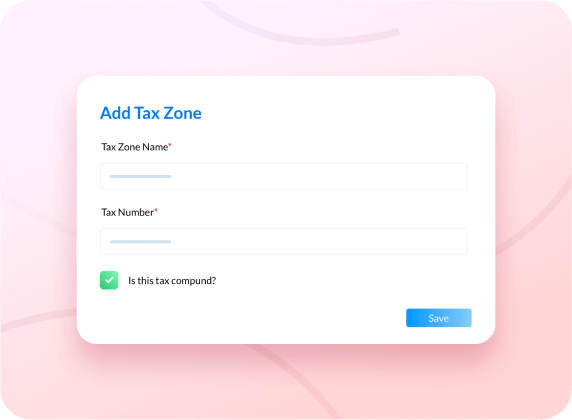

Tax Rates

Have different branches of your company

in different states? You can create as

many tax zones and tax rates for the

states as you want.

Tax Zone Name

Tax rates may be different for different cities.

This feature gives the opportunity to create

different zones so that different tax rates

can be set for different zones.

Tax Category

There are several types of tax categories

available. This feature gives the opportunity

to create different tax categories for

different tax rates.

Tax Payments & Agency

There may be one or several agencies

available that collect taxes. One agency

can have different tax rates for the same tax

category than other agencies.

Keep Track of Every Purchase

Transactions Inside The Module

Purchasing in cash, credit, or installments? No problem! Get the actual scenario of the total outstanding &

paid amounts, over-dues, partial & more with diagrams.

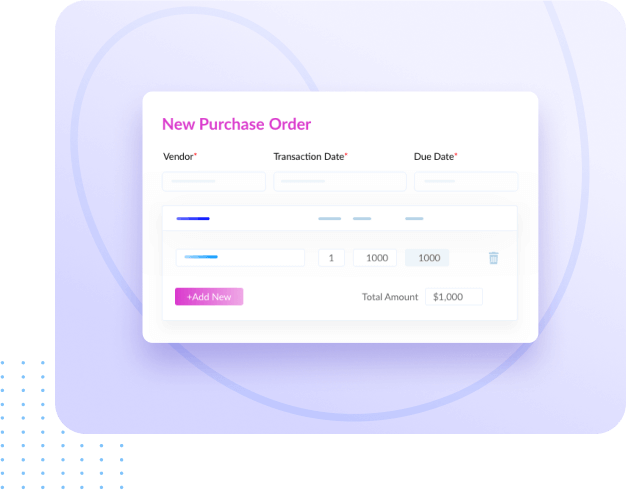

Create Purchase Order

Do you want to purchase inventories in the future, but

not sure to buy? Then this feature is ready to take

you to the rescue by allowing you to create a draft

purchase orders.

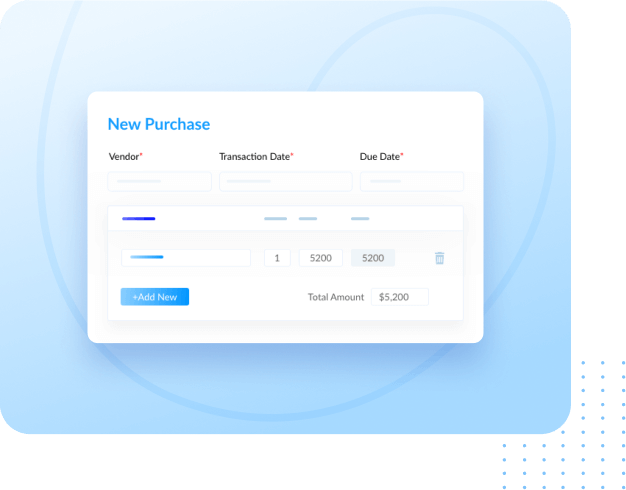

Purchase & Pay Purchases

With this feature, you will be able to create

purchase vouchers for your vendors anytime. You

can also make payments either from a bank or cash

account or pay partially. The amounts will be auto-adjusted.

Generate Accurate Financial Reports

With A Single Click

The best part is that you will be getting automated reports like a ledger, trial balance,

income statement, sales tax, and balance sheet just after entering a transaction into the system.