To do business on the WordPress Platform, WooCommerce is one of the best eCommerce solutions available. It comes with a built-in tool for gathering accurate business stats and transactional data. Which can be beneficial to maintaining your WooCommerce accounting & financial records.

However, understanding this data and turning them into an accounting record can be tricky. Sometimes, many business owners might not even understand the insights they are receiving.

So, in this blog, we are going to show you how WooCommerce accounting helps your business, how to utilize it with industry best practices, and suggestions for required tools.

Keep reading.

How WooCommerce Accounting System Can Benefit Online Businesses

Without proper accounting reports, you might be unable to assess the financial records and cash flow. Therefore, without understanding these records and reports, you won’t be able to take appropriate business decisions.

To track your revenues and expenses, the WooCommerce Accounting system keeps built-in & stable accounting procedures that can be understood easily even by non-accountants.

With the help of these reports and data, business owners can easily create essential accounting reports and make the right decisions whenever necessary.

Well, let’s get a bit of detail from the WooCommerce plugin itself and find out how its accounting feature keeps your financial data streamlined.

Inside the WooCommerce plugin, if you go to WooCommerce > Reports, you can find 4 kinds of reports. They can be categorized as –

- Orders

- Customers

- Stock

- Taxes

Orders

In this tab of the WooCommerce reports, you can get reports of revenue based on Sales by Date, Sales by Product, Sales by Category, Coupons by Date, and Customer Downloads.

From the names, you can easily understand what they mean –

- Sales by Date visualize an overview of the revenue earned from sales.

- From Sales by Product, you can get an overview of your sales data.

- From Products and Categories, you can find your top-selling products and categories.

- Coupon by Date shows the most popular coupons used by your customers.

- Customer Downloads show which downloadable products/services are ordered.

Customers

The Customers tab lets you view the reports for – Customers vs. Guests and Customer List. There’s an option for sorting this data by year, last month, this month, last 7 days, and custom date.

Customers vs. Guests shows the reports of paying users who register on your website vs guest users. The Customer List only shows registered users. There’s an option for searching for specific customers too.

Stock

In this tab of WooCommerce reports, the admin can access data on the inventory of the products/services. It shows the list of Low in stock, Out of stock, and Most stocked.

Taxes

The Taxes tab allows you to access reports of Taxes by code (state) and Taxes by date. by year, last month, this month, and custom dates.

With all these sales info, coupon usage, taxation rate, stock amount, and customer data, generating proper accounting data to represent business can be a lot easier. WooCommerce allows you to export these data to help you with your accounting efforts.

Best Practices for WooCommerce Accounting

WooCommerce provides you with plenty of data to work your way through processing, analyzing, and summarizing sales. So, you can keep track of your business effectively with proper accounting data.

But these kinds of data tracking or analyzing accounting stats require a complex process. These tasks will take plenty of time to complete unless you are a certified accountant. Meaning you will have less time to focus on your business.

If you follow the best practices that many industry leaders are familiar with, completing these tasks can get much easier than before.

We have carefully curated 5 of the best practices for WooCommerce accounting. Let’s dive in –

1. Link WooCommerce to WordPress Accounting Plugin

You might think, “Isn’t it possible for WooCommerce to take care of the whole aspect of my business’s accounting? I can take care of my business simply by checking the WooCommerce stats.”

It’s completely understandable to think this way, but you have to remember that WooCommerce’s main focus is to handle the eCommerce process. While it provides important information for accounting, to properly report the data, you might face inaccuracies.

These inaccurate records can harm your business significantly. If you are a non-accountant, then there’s a higher probability that maintaining transaction records will take a big portion of your time.

That time can be better spent helping your company to grow and focus on other sectors. To utilize your data, time, and effort, a good WordPress accounting plugin can boost your accounting efficiency! Here are some of the best WP accounting plugins available –

- WP ERP Accounting

- CBX Accounting and Bookkeeping

- QuickBooks Sync for WooCommerce

- Cost of Goods

You might think these plugins are costly. In reality, these plugins are cheaper than many WooCommerce Accounting extensions available. For example, the WP ERP Accounting module starts for as low as $12.99/month!

You can use these plugins to integrate with your website. Data can be imported and updated automatically if you set up Workflow Automation. You don’t even have to worry about entering items manually. There’s also no risk of human error in entering data or potentially missing valuable information.

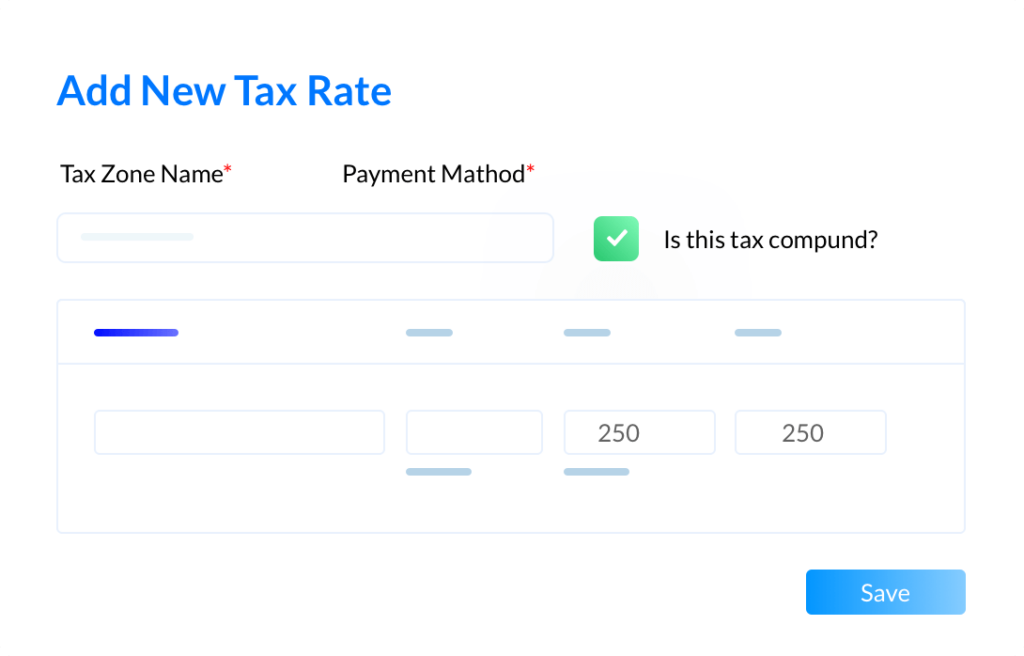

2. Configure Tax Rules

Configuring and managing tax-related work is the most complex but important work in accounting. Tax is a vital part of any business, but this is the part that gives owners the most painful experience.

Many businesses fail to configure tax accurately. Which is understandable. Let’s say you are doing business in California, USA. You have set up tax according to your state. But when you made a sale in Florida, you will find a very different accounting report because of the varying tax rates in Florida.

So, when you set up your shop, it’s important to set up and configure tax so that you won’t have to face any problems during tax season. If you use additional plugins, then this gets much easier as they have a built-in system for tax setups.

If you want to do it from WooCommerce, then there’s a whole document about Configuring Specific Tax Setups in WooCommerce that you can explore!

3. Use a Better Inventory Management Process

Good inventory management can save your time, products, and accounting efforts. A lot of things can happen in inventory. Products can get damaged, or expire. These situations mean a loss for your business. So it is necessary to keep track of all the products and their whereabouts.

If you do not keep track of your inventory, depreciation, or product damage-related losses in your accounting reports, you will not get an accurate forecast of your business.

Although WooCommerce keeps track of your stocks, there’s no way to find any real monetary report on those stocked products. So it’s better to use an accounting plugin to help you keep a better track of your inventory.

4. Generate Important Accounting Reports

You can get important data and insights from WooCommerce, but reporting them from the perspective of the Accounting Term is a difficult task. You might need to generate many important reports like –

- Growth Report

- Sales Return Report

- Purchase Return Report

- Purchase VAT Report

- Trial Balance

- Ledger Report

- Balance Sheet, and many more

From WooCommerce reports, your can export data about generic sales and

Tax report, but you won’t get the reports mentioned above. So, once again we are suggesting you integrate with an accounting system for your WooCommerce site.

5. Maintain Automated Workflow for Repeated Tasks

When we enter data manually, it’s normal to make mistakes. For accounting, these mistakes may come with a heavy cost. So it’s important to make sure you input data accurately. To avoid this, you can set up an automation workflow.

There are many tools out there to help you to maintain an automated workflow for the accounting process.

Unfortunately, very little automation exists inside WooCommerce. For example, whenever you get a new order from your site, WooCommerce will send an automated email to your admin email. Those emails are very simple and not many details are given.

But don’t worry. You can solve this problem by adding a WooCommerce extension that supports accounting modules to do the job.

The good news is that robust tools like WP ERP, AutomateWoo, Quickbooks, HubSpot, etc. are some of the best solutions you can look for. Because these tools enable automation for you while keeping your financial record accurate.

Automation brings greater opportunities as it helps reduce transactional and routine tasks such as data entry, bookkeeping, and compliance work. With the help of plugins like WP ERP, you can easily set this automation up in a minute!

How WP ERP’s Accounting Module Can Help Achieving The Best Practices

Most of the best practices we mentioned so far can be achievable with a third-party plugin. We’ve also mentioned many plugins, but out of all those, WP ERP stands out from the rest. Here’s how you can achieve all these with WP ERP’s Accounting Module –

1. Easy Integration with WooCommerce

WP ERP has a whole extension for WooCommerce. With the WooCommerce Integration extension, business owners can integrate their site to WP ERP.

Once the integration is complete, you can synchronize all your customer’s data and orders. Your sales overview is available to you along with your woocommerce data details. You can even check who has purchased less or more than a specific amount.

2. Configuring Tax Rules

WP ERP’s accounting module has built-in Tax Zones, Tax Categories, and Tax Agencies for easy tax configuration. If you get stuck, they will help you with complete documentation and support.

You can even get necessary reports like – sales tax reports and purchase vat reports automatically!

3. Inventory Management

WP ERP has its Inventory extension to help you keep track of your stock better than WooCommerce.

You can get important data like Inventory Stocks, Inventory Transactions, Product Categories, Tax Categories, and even Vendor dates if available on your site. You can even generate in-detailed reports automatically with the simple click of a button.

4. Generate Important Reports:

Managing or generating new reports from scratch is a difficult task even for professionals. Double checking for accuracy or maintaining the right format can be a complex process.

With WP ERP, these reports can be easily generated with a click of a button.

You can generate reports like –

- Trial Balance

- Ledger Report

- Income Statement

- Sales Tax

- Balance Sheet

- Returns Report

- Sales Report

- Purchase Report

- Reimbursements

5. Automating Important Accounting Workflow

To show how WP ERP helps with automation, let’s draw a case scenario –

Whenever a customer purchases your products or services, you have to provide them with an invoice. Doing this manually every time can be a big hassle, no matter how simple it seems.

With WP ERP’s Workflow extension, you can automate this whole process. All you have to do is the following –

- Go to Workflow to select the name of your automation and delay time.

- After that, edit your trigger options. For this case, you have to select the Accounting module. The event will be an “Added sale.”

- Now you will have 4 options as action, from that you need to select the invoice action. Write the email and select what your invoice will look like.

That’s it. You can create an automation workflow just like that. After activating the automation and you’ll never have to worry about sending invoices manually. This was just one example of many use cases.

Critical Takeaways for WooCommerce Accounting

In sum, properly setting up your WooCommerce accounting systems can help you create a more sustainable and profitable business. When you understand your business’s financial flow, you can take pinpoint action to grow your business further.

It might look overwhelming to some extent. So, we recommend you get started with the following things –

- Get to know the WooCommerce Reports data. Explore all sections/tabs and see how your business is performing.

- Connect your site with an accounting plugin or a complete business management solution like WP ERP. This way, you get additional insights and features on top of the WooCommerce Reports data

- Read the tax rules of your target audience’s location. Set up your tax with proper documentation. Take help if you need it.

- Keep an eye on your inventory. Check quality and quantity regularly.

- Understand what kind of insights you get from different accounting reports. This will help take better business decisions.

- Automate your accounting tasks. Especially the recurring tasks.

If you follow these industry best practices and utilize them, you will surely see a change in your business!