Feel employee salary management is a demanding and strenuous task? Think of the times when you had to do all your employee-related calculations on paper or other manual ways, so you erred more and eventually got done with less. Wage management can also be tiresome because of its monotonous and complex nature. But it doesn’t have to be this way anymore. With WP ERP’s Payroll extension, bid farewell to hours of laborious salary calculations and expenditures.

Payroll makes employee salary management completely automated.

With this HRM extension, Payroll, simply define the ways you want to calculate and disburse the salaries, and let the extension do the rest of the work for you. This solution ensures salary management isn’t so taxing as we usually accept it to be. Do your numerous calculations in an organized and enjoyable way and keep detailed records with this WordPress Salary Management system. With Payroll, staff wage management is no more boring!

Payroll automates the following business processes:

- Manage employee salary in automated ways.

- Get a bird’s eye overview of the payroll system from dashboard.

- Set up account heads for assets, salary and tax reporting from accounting module.

- Configure bank and tax details of individual employees

- Create dynamic weekly or monthly pay calendars and include different fixed amount payments.

- Choose specific payment methods for your employees and also for specific ones.

- Define employee remuneration and other fixed payments (allowance or deduction).

- Create pay calendars for each employee and set up basic pay rate.

- Run pay calendars on specific dates automatically for weekly, bi-weekly or monthly.

- Fetch employee information from HR module.

- Generate meaningful reports that help to take better decision.

- Create, print and email individual employee salary invoices.

- Integrates with both Accounting and HR module.

How to Use Payroll Extension & It’s Features

Installing Payroll is same as installing any other WordPress plugin:

- After purchasing, download Payroll from your My Account Page.

- Navigate to WP Dashboard → Plugins → Add New → Upload.

- Select and install Payroll.

- Finally, activate it.

Payroll’s Handy Features Step-by-Step

1. Set Salary with Detailed Fields in Employee Profile

Using the Payroll tab in each employee’s profile, you will set the basic pay or salary including different fixed amount payments. Payroll lets you add multiple allowances and deductions and also dynamically adds and subtracts them from the basic pay. The extension also lets you set up tax and other relevant information and automatically process salaries according to these fixed amounts.

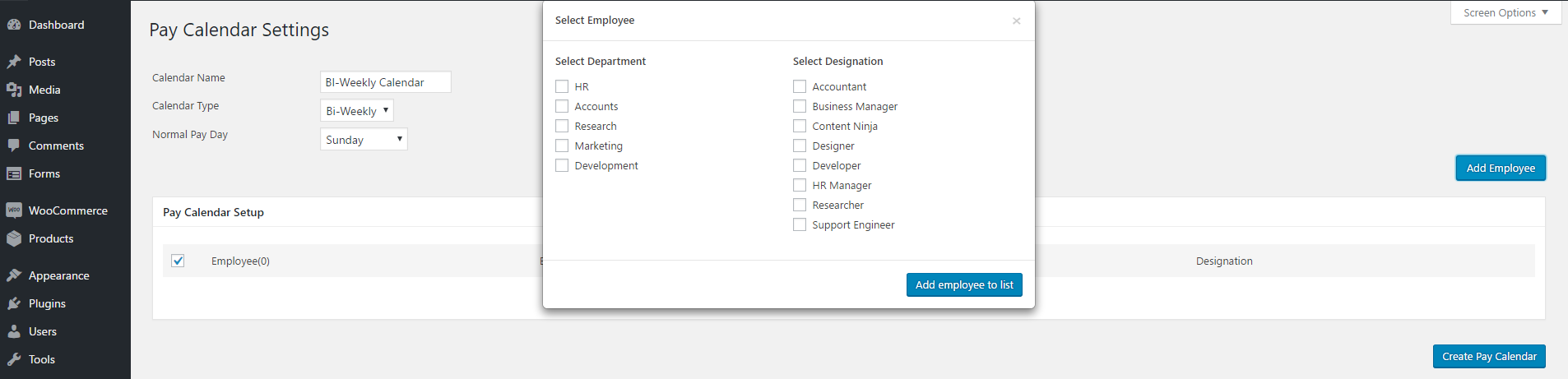

2. Create Pay Calendars & Customize

When are done setting up all the salary information on your staffs’ profiles, you can ready to create your Pay Calendar! The Pay Calendars are your disbursement repositories and plans.

With Payroll, create 3 types of essential pay calendars for salary disbursements: weekly, bi-weekly, and monthly.

For each pay calendar, you can add employees from any department and designation.

Icing on cake! The names of the departments and designations are seamlessly passed from the HRM module and integrated with Payroll so that you don’t have to separately create them again.

The Pay Calendar Settings will show you employee name, email, department, designation so that you can easily view everyone that has been added to a certain pay calendar.

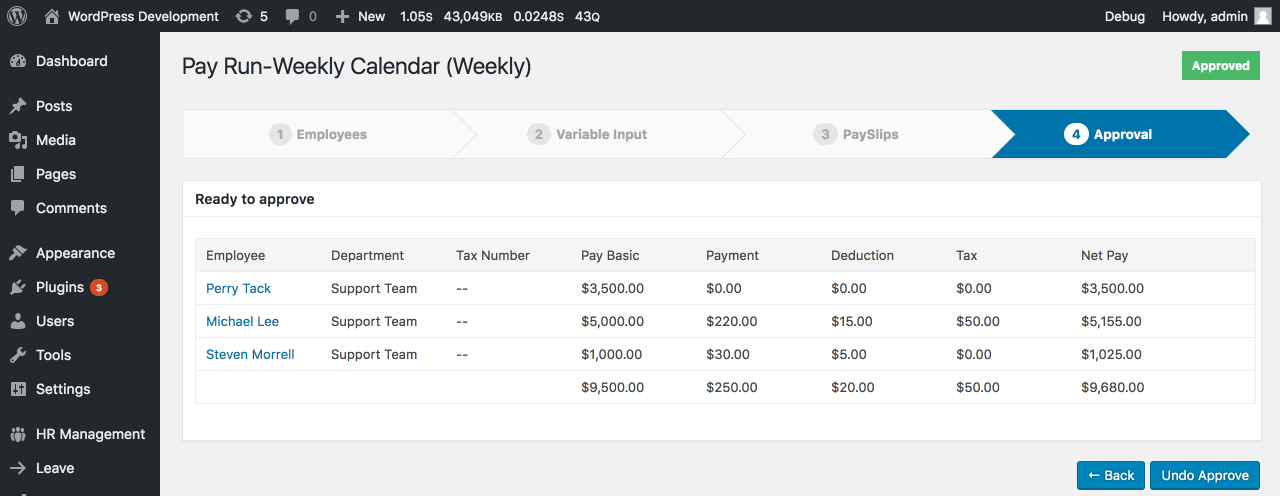

3. Start & Stop Pay Calendars with Pay Runs

Getting started with your salary disbursements is now just a click away!

Simply click on Start Pay Run located under each Pay Calendar to activate it.

You will be redirected to the Pay Run page for that Pay Calendar.

The Pay Runs let you specify range of dates and payment date.

Get to run a unique pay run each time, because after one pay run ends you have to run another one.

Specify the variable input options. You can add additional pay (such as, accommodation, overtime, holiday), non-taxable payments (e.g. expenses, redundancy, travel allowance), and deductions (such as, loan, provident fund, advance pay) wherever needed.

Approve the pay run when you are satisfied.

But you can also un-approve if required simply by clicking the undo button. That’s how flexible but safe Payroll is!

4. Generating Reports for Decision Making

Payroll generates 2 types of reports: Employee-wise and a Summary.

These detailed reports not only give you numbers but help you to make better decisions for your next disbursements.

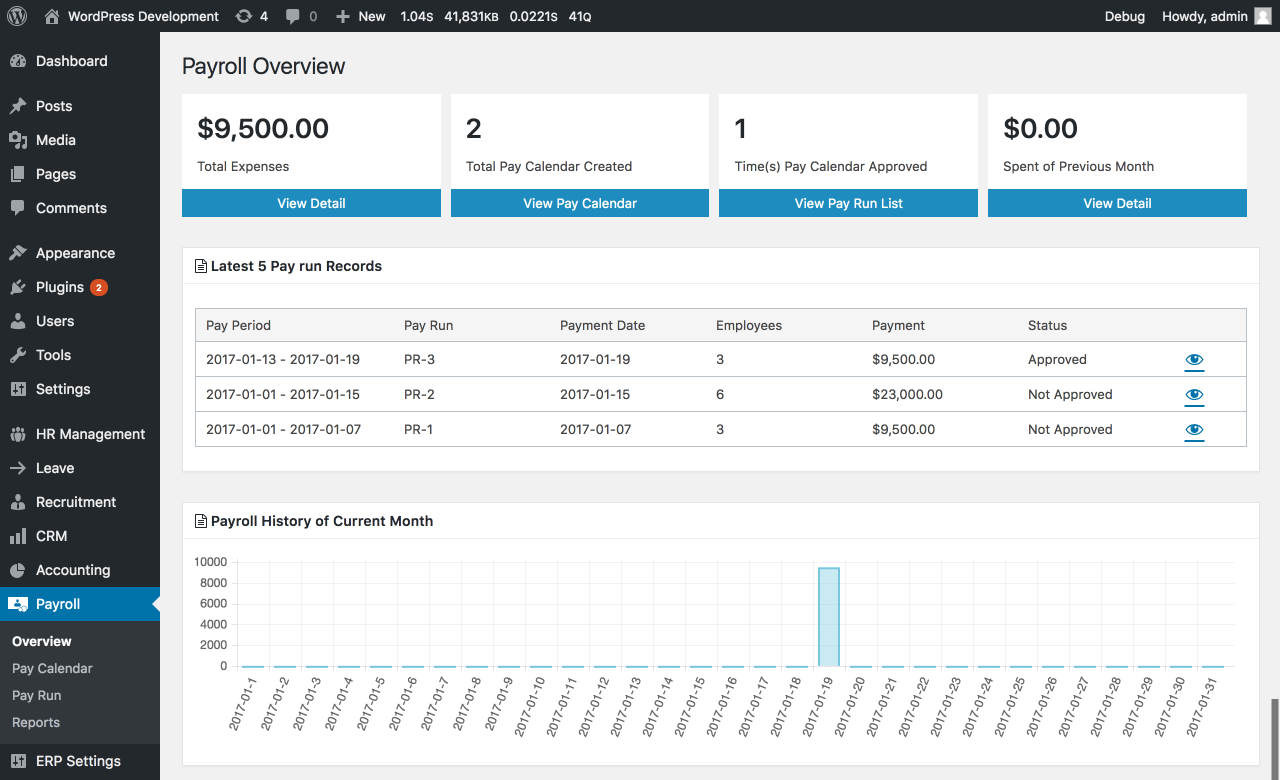

5. Finally See Everything with ‘Overview’

From the overview page you can get a bird’s eye view of your payroll system which displays all important and useful insights in a single page:

- Total expenses

- Total pay calendar created

- Times pay calendar approved

- Amount spent on previous month

- Latest list of pay run records

- Payroll history with smart insights

This page lets you quickly revise and refresh your memory you have done so far with your payroll activities.

Automate your Salary Management Processes with Payroll

Manage employee compensation efficiently with an automated payment system like Payroll for WP ERP.

With Payroll extension for WP ERP, simultaneously manage your HR & Accounting transactions. This WordPress Payroll Plugin automates & organizes the entire calculation & disbursement process so that it’s no more taxing for you to do salary management. Now get to do your employee wage management faster with more efficiency!

Wow, a WP payroll plugin? This is impressive. Any insights as to how the plugin supports 1099 and W-2 filing at the end of the year? Any data export functions? This looks like such a great option for small businesses who operate online.

does this do direct6 deposit??